In a rapidly evolving financial landscape, the need for innovative solutions that cater to diverse market needs has never been more critical. World Liberty Financial (WLF) stands at the forefront of this transformation, offering a broad array of financial services designed to empower individuals and businesses globally. This article delves into the history, services, and impact of World Liberty Financial, highlighting its role in shaping the future of global finance.

Overview

Founded with the vision of creating a more inclusive financial system, World Liberty Financial aims to bridge the gap between traditional finance and emerging markets. The company leverages cutting-edge technology and a customer-centric approach to provide accessible financial solutions that empower clients to achieve their financial goals.

Mission and Vision

World Liberty Financial's mission is to democratize access to financial services, ensuring that individuals and businesses, regardless of their geographical location or economic status, have the tools they need to thrive. The company's vision encompasses a world where financial freedom and opportunity are available to everyone, fostering economic growth and stability.

1. International Banking Solutions

World Liberty Financial provides a range of international banking services designed to meet the needs of individuals and businesses engaged in global trade. These services include:

Foreign Currency Accounts: Clients can hold multiple currencies in their accounts, facilitating international transactions and reducing exchange rate risks.

International Wire Transfers: WLF offers competitive rates and fast processing times for international wire transfers, making it easier for businesses to manage cross-border payments.

Trade Financing: The company provides trade finance solutions, including letters of credit and invoice financing, to help businesses manage their cash flow and mitigate risks associated with international trade.

2. Investment Services

WLF offers a comprehensive suite of investment services aimed at helping clients grow their wealth. These services include:

Wealth Management: World Liberty Financial’s wealth management team provides personalized investment strategies tailored to clients’ financial goals and risk tolerance. This includes portfolio management, retirement planning, and tax optimization.

Real Estate Investment: WLF facilitates real estate investment opportunities, allowing clients to diversify their portfolios and capitalize on emerging markets.

Alternative Investments: The company offers access to alternative investment opportunities, including private equity and hedge funds, providing clients with the chance to enhance their returns.

3. Insurance Solutions

Understanding the importance of risk management, World Liberty Financial offers a range of insurance products designed to protect clients' assets and investments. These include:

Life Insurance: WLF provides various life insurance options, ensuring that clients can secure their loved ones' financial futures.

Property and Casualty Insurance: The company offers comprehensive coverage for homes, businesses, and vehicles, helping clients mitigate risks associated with property damage and liability.

Health Insurance: WLF provides health insurance solutions that prioritize clients' well-being, offering coverage for medical expenses and preventative care.

4. Financial Education and Advisory

World Liberty Financial is committed to empowering clients through education. The company offers a range of resources and advisory services, including:

Financial Literacy Programs: WLF provides educational resources to help clients understand financial concepts, investment strategies, and risk management.

Personalized Financial Counseling: The company offers one-on-one consultations with financial advisors, allowing clients to develop tailored financial plans that align with their goals.

Workshops and Seminars: WLF organizes workshops and seminars on various financial topics, fostering a culture of continuous learning and empowerment.

1. Promoting Financial Inclusion

In a world where many individuals and businesses lack access to essential financial services, World Liberty Financial plays a crucial role in promoting financial inclusion. By offering services that cater to underserved markets, WLF helps bridge the gap between traditional banking and the needs of diverse populations.

2. Supporting Global Trade

With the rise of globalization, businesses increasingly rely on international trade to expand their markets. World Liberty Financial’s international banking solutions and trade financing services support businesses in navigating the complexities of global commerce, ultimately driving economic growth.

3. Fostering Economic Development

By providing access to investment, banking, and insurance services, WLF contributes to economic development in emerging markets. The company’s focus on empowering clients with the tools they need to succeed fosters entrepreneurship and innovation, helping communities thrive.

4. Enhancing Financial Literacy

World Liberty Financial’s commitment to financial education empowers individuals to make informed decisions about their finances. By promoting financial literacy, WLF helps clients build a solid foundation for managing their money, investing wisely, and planning for the future.

1. Navigating Regulatory Landscapes

As a global financial services provider, World Liberty Financial must navigate complex regulatory environments in different jurisdictions. Compliance with local laws and regulations is essential for maintaining trust and credibility in the markets they serve.

2. Adapting to Technological Change

The financial industry is undergoing significant technological transformation, with innovations such as blockchain, artificial intelligence, and digital currencies reshaping the landscape. World Liberty Financial must continuously adapt to these changes to remain competitive and provide cutting-edge services.

3. Addressing Cybersecurity Threats

As the reliance on digital platforms grows, so does the risk of cyberattacks. World Liberty Financial must prioritize cybersecurity measures to protect client data and maintain trust in its services.

4. Expanding Market Reach

While WLF has made significant strides in promoting financial inclusion, there remain untapped markets with potential for growth. Expanding its reach into underserved regions can provide new opportunities for the company and its clients.

1. Embracing Digital Transformation

World Liberty Financial is poised to embrace digital transformation as it seeks to enhance its service offerings. This includes investing in technology that improves user experience, streamlines processes, and increases efficiency across its operations.

2. Expanding Product Offerings

To meet the evolving needs of clients, WLF plans to expand its range of financial products and services. This could include the introduction of innovative investment vehicles, enhanced insurance solutions, and tailored financial planning services.

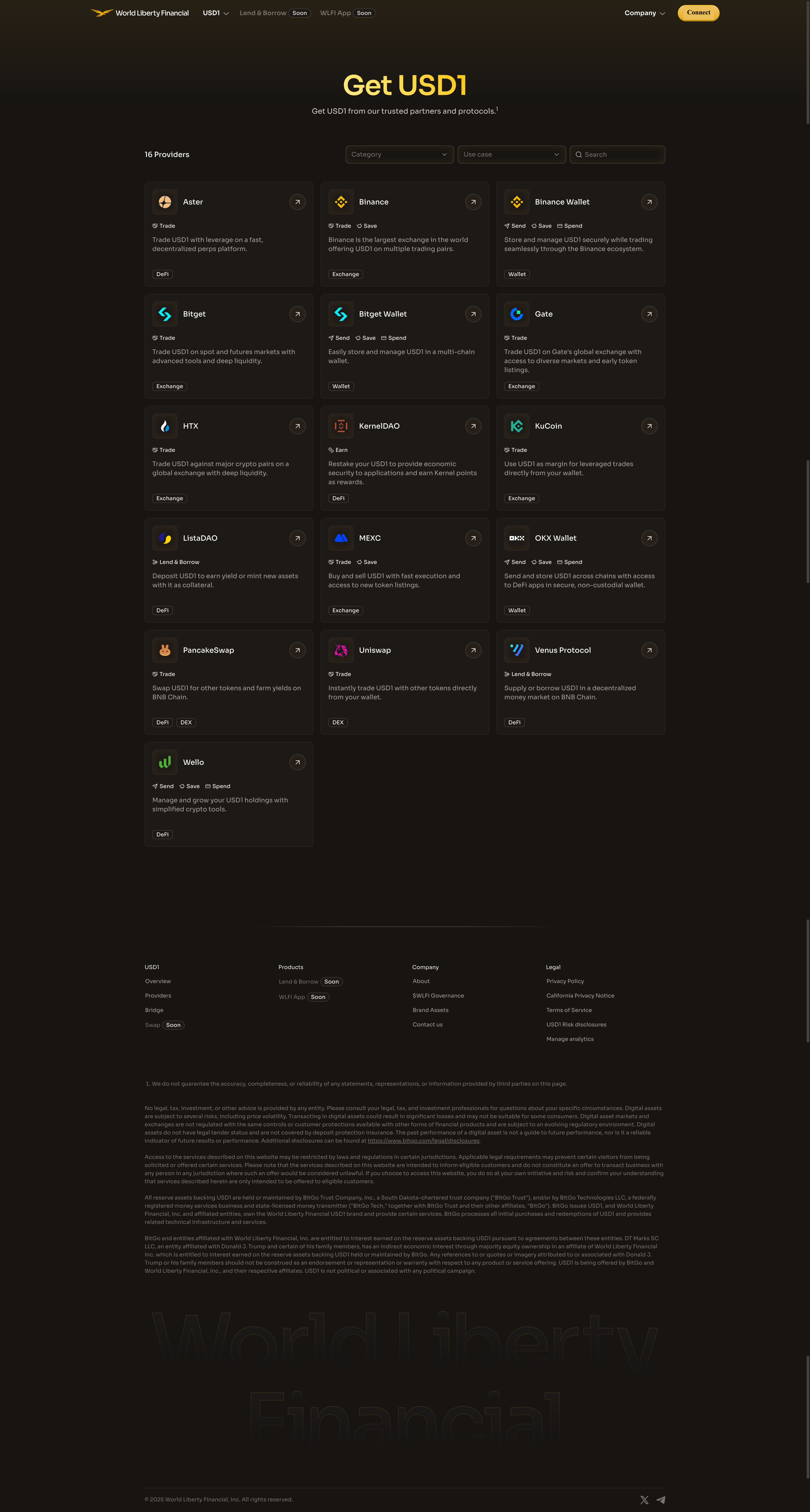

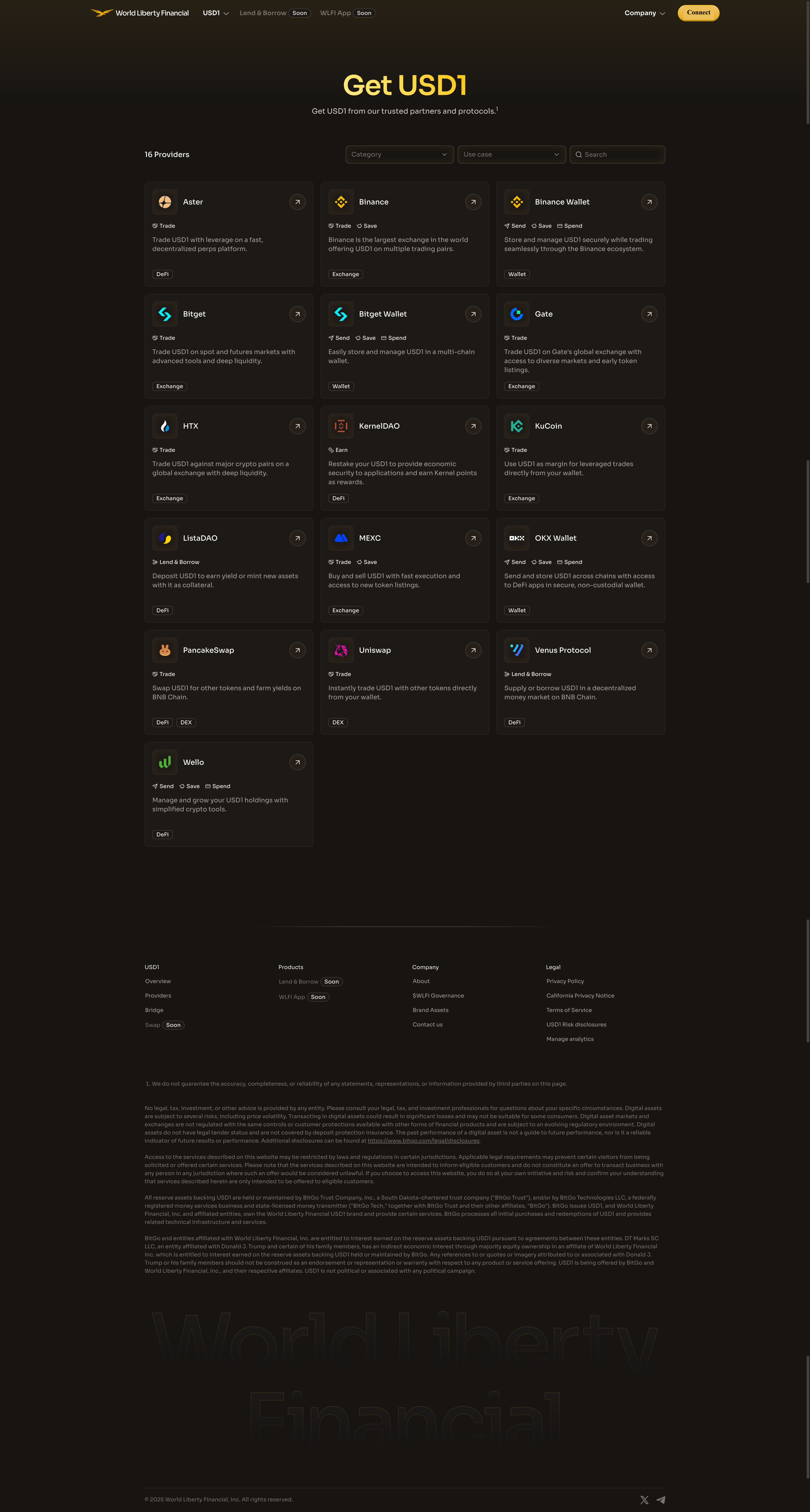

3. Strengthening Partnerships

Building strategic partnerships with other financial institutions, technology providers, and community organizations will be crucial for WLF’s growth. Collaborations can enhance service offerings and expand market reach.

4. Enhancing Customer Engagement

World Liberty Financial aims to deepen customer engagement through personalized services and improved communication. By leveraging data analytics and customer feedback, the company can better understand client needs and enhance the overall experience.

5. Commitment to Sustainability

As the global focus on sustainability intensifies, WLF is committed to integrating environmentally conscious practices into its operations. This includes offering sustainable investment options and supporting initiatives that promote social responsibility.

World Liberty Financial stands as a pioneering force in the financial services industry, committed to democratizing access to essential financial solutions. With a focus on innovation, customer empowerment, and global reach, WLF is well-positioned to navigate the complexities of the modern financial landscape. As the company continues to evolve and adapt to emerging trends, its impact on financial inclusion, economic development, and global trade will be profound. Through its dedication to empowering individuals and businesses, World Liberty Financial is shaping the future of finance and fostering a world where financial freedom is accessible to all.

HTML Creator